food tax in massachusetts calculator

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The meals tax rate is 625.

4 Ways To Calculate Sales Tax Wikihow

The Massachusetts income tax rate.

. Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers. The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income. That goes for both earned income wages salary commissions and unearned income.

This takes into account the rates on the state level county level city level and special level. This income tax calculator can help estimate your average. While many other states allow counties and other localities to collect a local option sales tax.

This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules. The average cumulative sales tax rate in the state of Massachusetts is 625. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

In the state of Massachusetts any service charge by a caterer is not considered to be taxable so long as the caterer prepares food which was owned by the client at a fixed location on an. So the tax year 2022 will start from July 01 2021 to June 30 2022. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Before-tax price sale tax rate and final or after-tax price. Before-tax price sale tax rate and final or after. Your average tax rate is 1198 and your.

Massachusetts has a separate meals tax for prepared food. Purchase Amount Purchase Location ZIP Code -or-. The Boston Massachusetts sales tax is 625 the same as the Massachusetts state sales tax.

15-20 depending on the distance total price etc. Estimate Your Federal and Massachusetts Taxes. The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year.

Find your Massachusetts combined state and local tax rate. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. After a few seconds you will be provided with a full.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

State Auditor Suzanne Bump announced Thursday that she had. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. The Federal or IRS Taxes Are Listed.

That statewide tax is currently 625 which is also Massachusetts statewide sales tax rate. The tax is 625 of the sales price of the meal. Massachusetts is a flat tax state that charges a tax rate of 500.

Overview of Massachusetts Taxes.

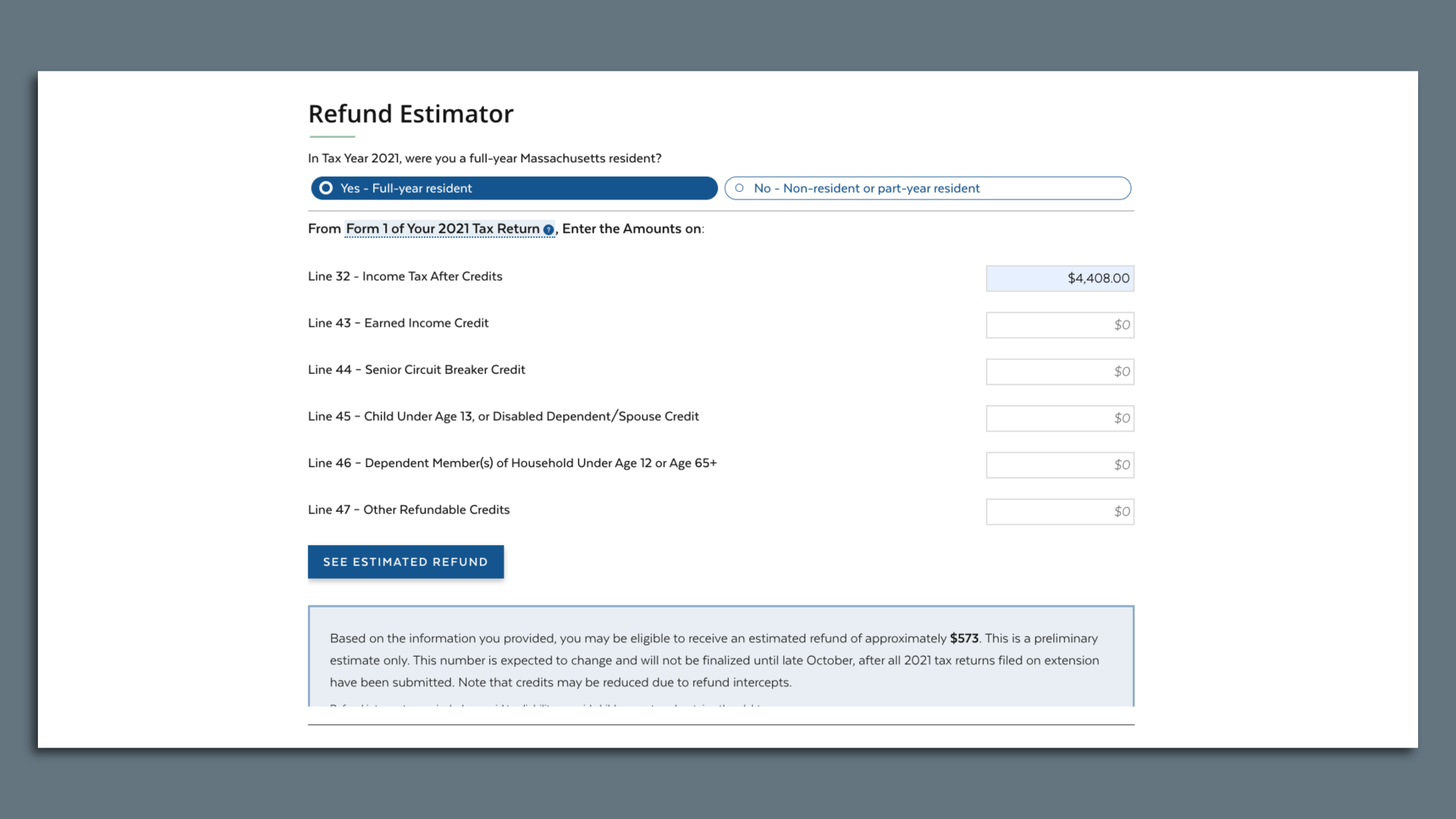

How To Calculate Your Projected Massachusetts Tax Rebate Axios Boston

Do I File State Taxes If I Won The Massachusetts Lottery

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

A Guide To State Sales Tax Holidays In 2022

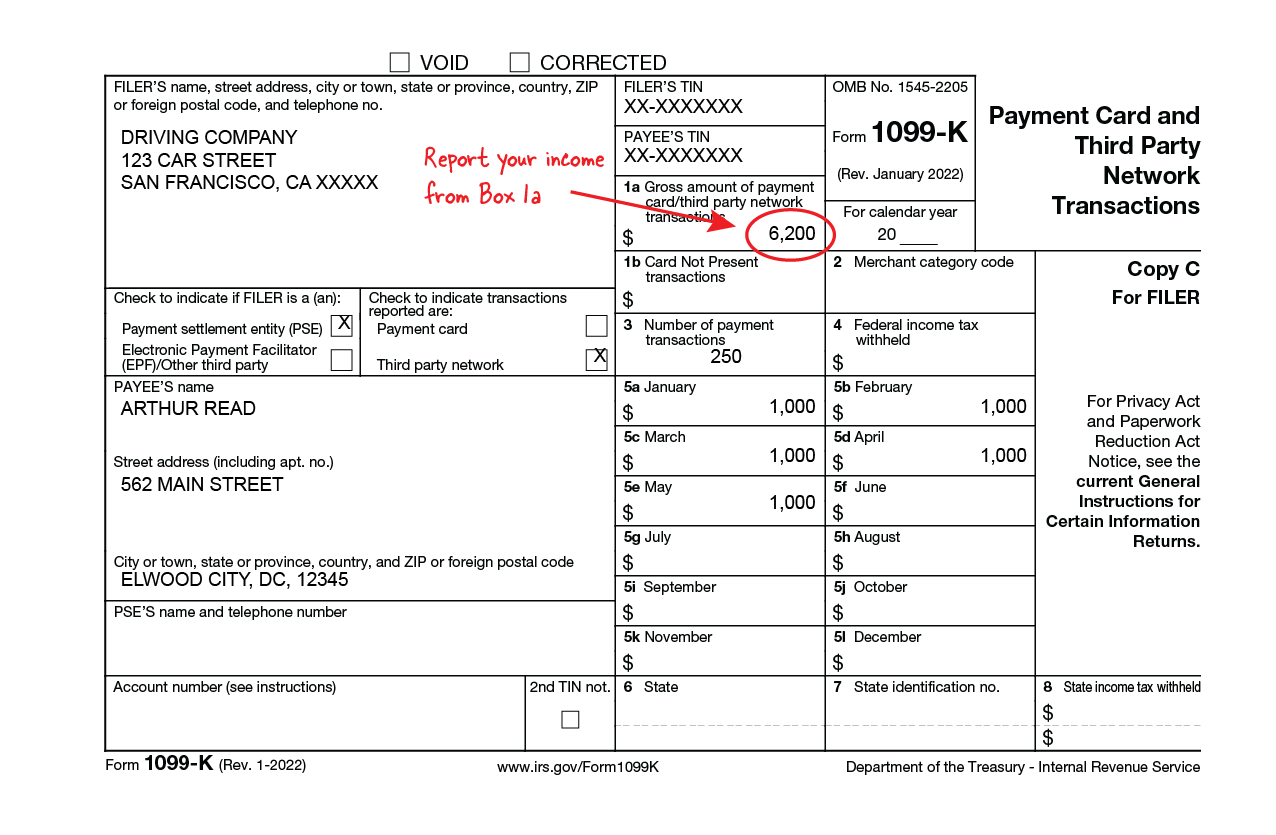

How Do Uber And Lyft Drivers Count Income Get It Back

How To Calculate Sales Tax And Avoid Audits Article

Maine Sales Tax Calculator And Local Rates 2021 Wise

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

New Tax Law Take Home Pay Calculator For 75 000 Salary

How To Calculate Sales Tax And Avoid Audits Article

New Tax Law Take Home Pay Calculator For 75 000 Salary

Cost Of Attendance Texas A M University Commerce

![]()

Everything You Need To Know About Restaurant Taxes

New York City Sales Tax Rate And Calculator 2021 Wise

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)